Have you ever heard these: "Social responsibility of an entrepreneur is simple, just making profits and responsible to their shareholder!" Coincidentally, Milton Friedman, an influential economist had put forward a similar insight as far back as 1970: "The Business of Business is Business" But... is that still convincing nowadays?

Tax Avoidance

I. What is Tax?

Before digging into the topic, let's ask a pure question, what is tax? Tax, in a nutshell, is a channel for the government to collect revenue from social actors, including corporate entities and citizens, to finance the expenditure and sustain the smooth operation of the state and society.

To link the theme of corporate social responsibility more concentrically, the article will first explain the motivations for companies to avoid corporate tax, and then elaborate the concept of Corporate Social Responsibility to expand the discussion about whether the companies should pay the tax.

II. Corporate Tax in Global Perspective

Generally speaking, to receive the potential revenue as more as possible, the state levies the corporate tax on companies operating in her jurisdiction, and the tax rate may vary based on each countries' tax policies. According to the research of OECD, the United States has the highest tax rates, which at about 35.5%, yet simultaneously, Ireland has 12.5 % tax rate, which is almost 1/3 of United State. (McCarthy, N.,2016)

III. Tax Avoidance

With the expansion of corporate business, the cost from corporate tax has also become larger, which has more or less become an obstacle to corporate development. Fortunately, there're legal strategies for the entrepreneur to minimize tax, namely tax avoidance. How is it work?

Imagine that you were the entrepreneur who spent 1 million to establish a company on the United State (35% tax rate), once subtract the 350k tax, you would profit about 650k. You, however, found that there's the corporation tax rate gap among countries, so you decided to migrate a part of the business to the other countries with the lower tax rate. Take Canada as an example, after migrating 800k to it, you can eventually profit about 810k from your mother country (United State 130k ) and host country (Canda 680k) in total. The case above implies that tax avoidance can create the potential profit of the multinational corporation, which seems consistent with the ultimate purpose of holding a business.

Compare with tax avoidance, tax evasion is an illegal tax minimization activity, usually refer to some intentionally under-report their income to the tax authority, and it is, therefore, subject to legal regulation. So, can we conclude that tax avoidance is appropriate behaviour for the company to shrug off the high corporate tax?

Business Beyond Business?

I. Evolution of MNCs :

The earliest multinational company is generally considered to be the East India Company that established in 1603, which incorporates unprecedented corporate elements such as multinational manufacturing and shares issuing, and its scale model has echoed through the ages.

Turning to the 70s, the increasing number of the multinational corporation is remarkable, grow from 7276 to 19000 between 1968 and 1998, which raised about 1.6 times. (Zekeri, M, 2018)

II. Influences of MNCs :

When it comes to 90s, information technology has greatly reduced the cost of managing global production and sales networks, and it has also made it easier for companies to promote products, services, and production technologies to the international market.

As of 2016, there are at least 8 million multinational companies worldwide, and this business model seems to be the embodiment of whether the companies have great market influence. (Egu, M. E., 2014)

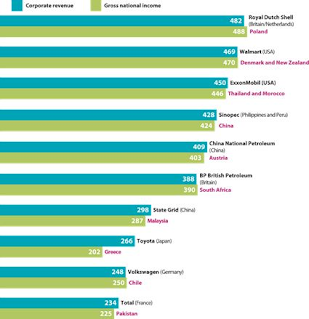

In fact, the income of many multinational companies has surpassed that of their home countries, Royal Dutch Shell, for example, has earned 482 billion US dollars, and 24% more than his mother country Britain. It's obvious that the market power that the multinational companies owned is strong enough to interpose in the decision making of government, and it envokes some concern: should businessman leverage their influences to achieve certain social goals like environment protection, social sustainability or employment encouragement? Should the business beyond business?

III. Corporate Social Responsibility:

This term originated from the book "Social Responsibilities of the Business" by Howard R. Bowen, and he mentioned that company has the obligation to obey the moral norm, and contribute to the economic development, improving the local welfare and living standard of labours. (Bowen, H. R., 2013). Besides, according to the stakeholder theory, the company should not only concern about the avails from shareholders, but all stakeholder related to the corporate operation, from employees to consumers, from community to environment.

After reading the article above, some may indicate that the more power comes more responsibility, the companies, therefore, have an obligation to reject tax avoidance, and furnish the tax to influenced countries, to alleviate the social unfairness and injustice; And some may opine that is over-idealized, how can we count on a businessman who is enthusiastic about making profits to concern about the interest of others? Even though this kind of dedication is profit-free and even jeopardize the interest of himself? What're the arguments of the affirmative and negative parties in this debate of tax avoidance? So, how do you think?

Reference:

-https://www.centreforassessment.co.uk/news/the-business-of-business-is-business/

-David Held (ed.) 2000. A Globalizing World? (p.105)

-Zekeri, M. (2016). Multinational Corporations (MNCs) and Corruption in Africa. Journal of Management and Social Sciences, 5(2), 80-96.

-Stojkovic, R. Z., Prokopovic, Z. B., & Raicevic, M. S. (2013). Economic-Political Power and the Role of Global Corporation in Modern World. Ekonomika, Journal for Economic Theory and Practice and Social Issues, 59(1350-2019-2148), 166-173.

-David Held (ed.) 2000. A Globalizing World? (p.105)

-Zekeri, M. (2016). Multinational Corporations (MNCs) and Corruption in Africa. Journal of Management and Social Sciences, 5(2), 80-96.

-Stojkovic, R. Z., Prokopovic, Z. B., & Raicevic, M. S. (2013). Economic-Political Power and the Role of Global Corporation in Modern World. Ekonomika, Journal for Economic Theory and Practice and Social Issues, 59(1350-2019-2148), 166-173.

-https://www.investopedia.com/terms/t/tax_avoidance.asp

-McCarthy, N. (2016):"Global Corporation Tax Levels In Perspective". retrieved from https://www.statista.com/chart/5594/global-corporation-tax-levels-in-perspective/

-Egu, M. E. (2014). The strategic importance of regional economic integration to multinational companies (MNCs): A study of South African MNCs' operations in the SADC (Doctoral dissertation, University of South Africa).

-Bowen, H. R. (2013). Social responsibilities of the businessman. University of Iowa Press.

This is very serious stuff. It would be good to let us know your thoughts. Make it simpler and more straightforward. But everything else is good.

回覆刪除William Sin

Tax Avoidance is a very serious issue affecting all of us. I feel astonished after reading you guys articles. The big firms such as Google and Amazon have leveraged its resources and legal professionals to set up branches with an aims to avoiding taxes. It is extremely unfair to the nation that they base on or operate in. It is their obligation to return some of their profits for social development. Their acts are intolerant and should be punished, but like you guys said in the article, nowadays, the MNCS have earned too much profits that they can now influence the states'' policies by bribing the officials or councilors. Hence they cannot be punished and their power have blossomed to a degree that noone can check and balance them. It is very dangerous and make the wealth gap between the wealth and poor become larger.

回覆刪除Hung Tak Chun 11288437

Lai Wai Ching

刪除it is great to see you have mentioned the corruption problems and exploitation problems. Just like you mention MNCS have big power to influence the local culture or economic, especially in the globalization world, the typical negatives could always be found in many sweatshops and export processing zones (EPZs)/free-trade zones with extensive tax-free/preferential treatments from host countries, due to host countries want to attract MNCS invest or create a job opportunity, that why although MNCs create social problems, but no one takes it seriously.

Tax avoidance occurs in every aspects. I would like to discuss about The Corporate Social Responsibility mentioned in part 3 . Whether big company takes advantage from the tax law loophole is controversy. What if the government is doing harm to the society? Tax from big firm will be used for suppressing people and prohibit company from fulfilling its company aims. The responsibility must be the government from multinational which cannot gain the taxes by law.

回覆刪除On the other hand, companies should also payback the nation that they registered as they provide environment to the company.

Lai Wai Ching

刪除I agree that the government should take the responsibility to supervise the multinational company.Also,big company takes advantage from the tax law loophole is controversy , it is not fair competition to other company that have implement business ethical behavior and obey the law spirits .I think education is important, maybe we can let multinational company know about business ethical behavior brings good brand name and decrease risk, to change their mindset.